Our successes say it all - check out our customer reviews

Specialists in researching fantastic mortgage products & interest rates

With our catalogue of products from a comprehensive range of mortgages from across the market, our mortage advisors will quickly find a mortgage that suits your individual needs

Our mortgage advisors offer a national service and can offer mortgage advice to anyone in the UK. Our company headquarters is in Southend-on-Sea and we have a secondary office in Leigh-on-Sea. Our services are accessible from all of the below areas:

Shoeburyness, Great Wakering, Thorpe Bay, Southend-on-Sea, Westcliff-on-Sea, Leigh-on-Sea, Benfleet, Hadleigh, Thundersley, Rochford, Hockley, Ashingdon, Rayleigh, Wickford, Basildon, Billericay, Pitsea. Plus, all over towns from Essex to London.

We have mortgages to suit all of our members

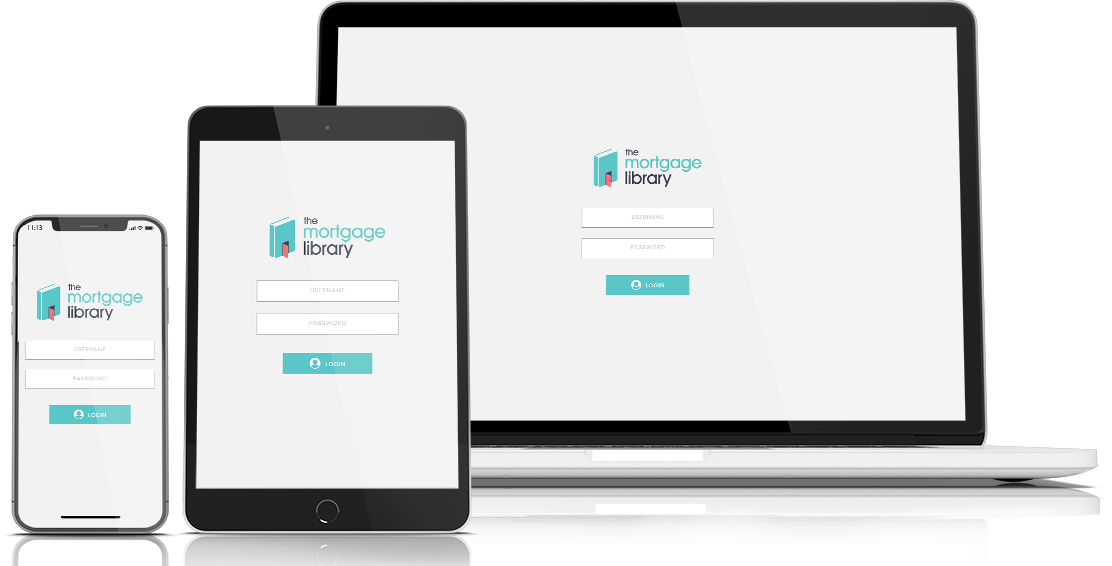

Track the progress of your mortgage application quickly and easily via our online customer portal

Find out if you are eligible today... Without affecting your credit score

Find out how our librarians can help you

Open 7 days a week including bank holidays

Mon - Fri: 9AM - 6PM, Weekends & Bank Holidays: 10AM - 4PM

By Mollie Rising | 01 September 2021

Are you preparing to purchase your first home? If [...]

By Georgie Harris | 19 August 2021

Later life lending provides homeowners over the ag [...]

By Jay Thain | 03 October 2020

What is Shared Ownership? A shared ownership mort [...]

By Georgie Harris | 29 May 2020

Owning property to rent out can be a great investm [...]